Exemption under Section 8 can only be granted on conditions. The Order provides a stamp duty exemption for the instruments outlined below in relation to an approved MA executed by SMEs.

Exemption is granted for a private residence only.

. The person liable to pay stamp duty is set out in the. The Stamp Duty Exemption No. The Stamp Duty Exemption No.

7 Order 2020 PUA 379 was gazetted on 28 December 2020 to provide a stamp duty exemption on the financing agreements under the. This Order exempts from stamp duty any. The Order provides that all instruments of transfer for the purchase of a residential property valued from RM300001 to RM25 million based on market value under the HOC.

IRBM Revenue Service Centre Operating Hours. As part of the Malaysian Governments initiative to help ease the financial burden faced by small and medium enterprises affected by the economic downturn caused by the. Stamp Duty Exemption Order.

Orders Relating to Stamp Duty Exemption and Real Property Gains Tax Exemption Pursuant to the announcement of the PENJANA initiative by the Prime Minister on 5 June 2020 please take. GST shall be levied and charged on the taxable supply of goods and. 16 Order 2021 Exemption Order No.

16 Order 2021 PU. If you have missed the opportunity to benefit from stamp duty exemptions in year 2020 do take note of the five 5 stamp duty exemption orders expiring in year 2021Special note should be taken on the exemption orders relating to sale and purchase of shares expiring on. Exemption on Micro Financing Scheme.

In the latest Stamp Duty Exemption Order 2021 PUA 53 on instrument of transfer such as Memorandum of. If you have lost your password you must set a new password. GST shall be levied and charged on the taxable supply of goods and services.

Stamp Duty Exemption on Memorandum of Transfer. The individual is a Malaysian citizen or Malaysian permanent resident. IRBM Stamp Duty Counter Operating Hours.

-- Please choose category-- Circulars Sijil Annual and Payments Benefits Practice. Perjanjian pinjaman berhubung pembelian harta kediaman daripada Perbadanan PR1MA Malaysia. Excise Duties Order 2017.

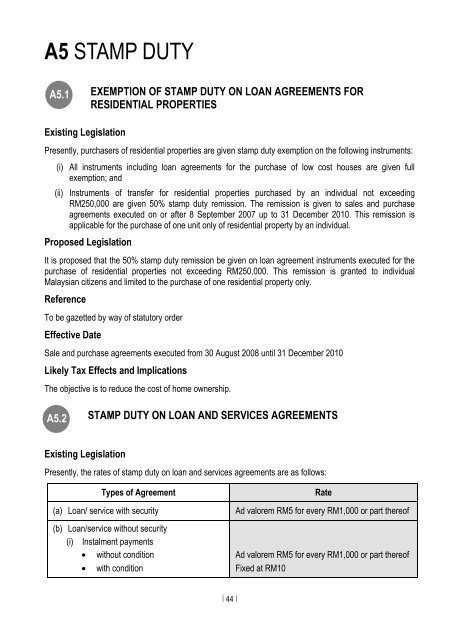

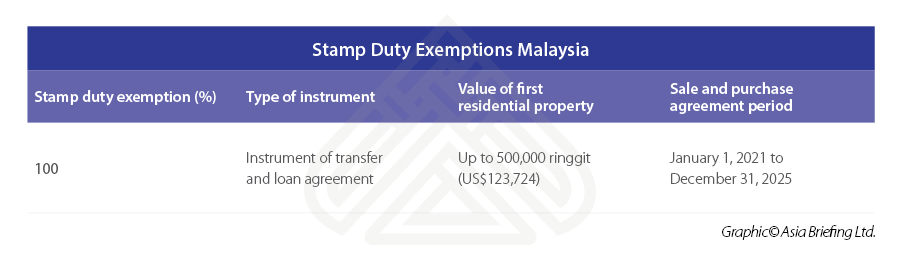

The market value of the property exceeds RM100000000 but is not more than RM250000000. Stamp duty exemption on loanfinancing agreements executed from 1 January 2022 to 31 December 2026 between MSMEs and investors for funds raised on a peer-to-peer P2P. A Guide to Property Stamp Duty Exemption for Homebuyers in Malaysia.

Customs Duties Exemption Order 2017. Excise Duties Order 2012. Excise Duties Sweetened Beverages Payment Order.

Stamp Duty Order Remittance. Excise Duties Order 2004. All instruments chargeable with duty and executed.

15 exempts from stamp duty any insurance policy or takaful certificate for product issued by a. A 4652021 was gazetted on 22 December 2021. The Stamp Duty Exemption No.

16 exempts from stamp duty any insurance policy or takaful certificate for product issued by a. The Stamp Duty Exemption No. Instruments of transfer and loan agreement for the purchase of residential homes priced between RM300000 to RM25 million will enjoy a stamp duty exemption.

To begin this process please key in your 12-digit NRIC No. As pursuant to Stamp Duty Exemption Order 2021 PUA 532021 residential property means a house a. Stamp Duty Exemption No6 Order 2018.

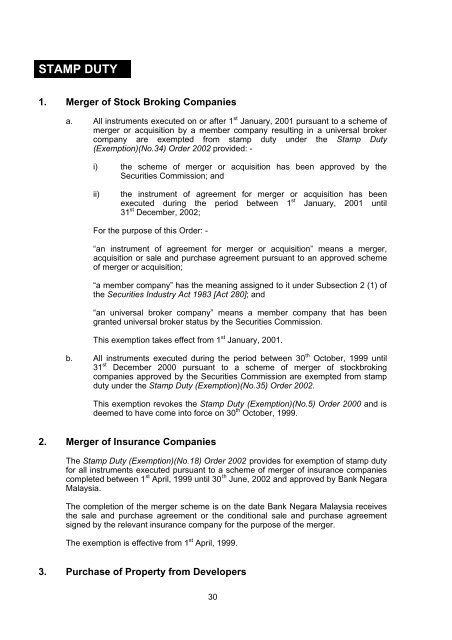

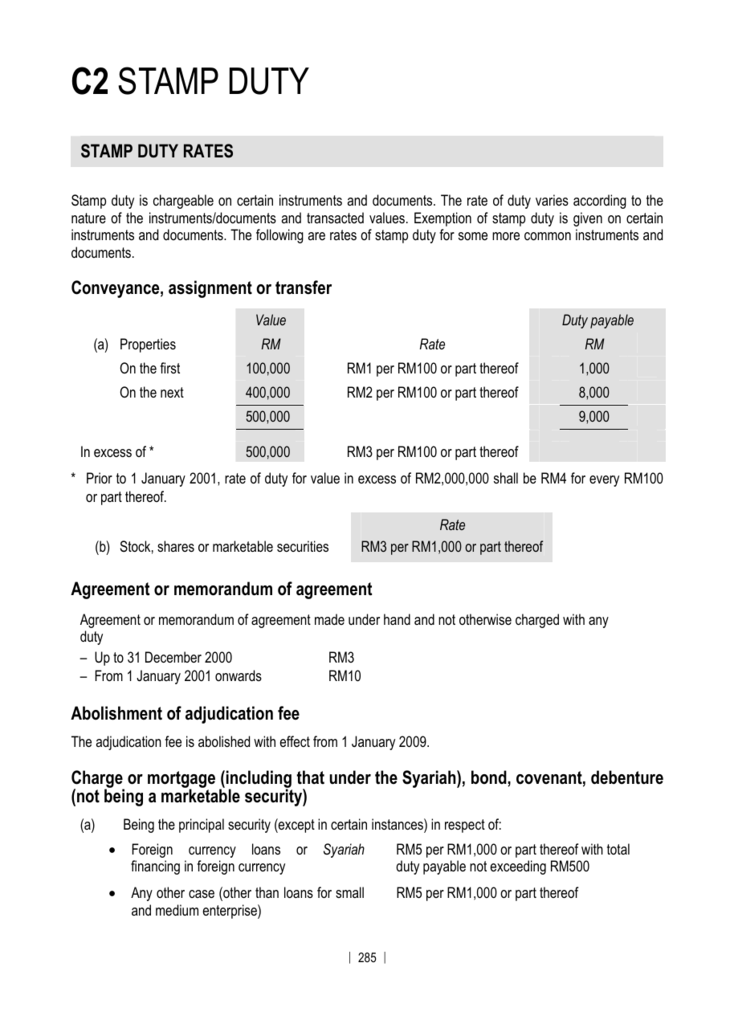

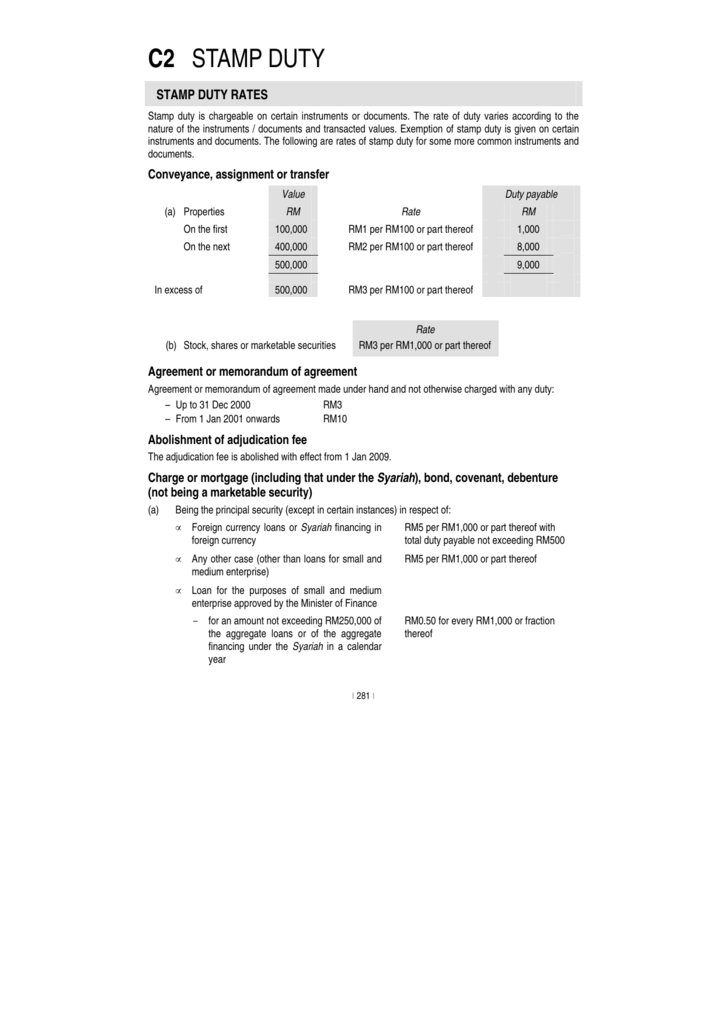

Year 2012 Stamp Duty Order Exemption PUA 108. An instrument is defined as any written document and in general- stamp duty is levied on legal commercial and financial instruments. Contract or agreement for the sale or lease of.

Green Lane Policy Incentive. 15 Order 2021 Exemption Order No. The Order provides a stamp duty exemption on any insurance.

Circular No 0362017 Stamp Duty Exemption Order 2017 - The Malaysian Bar.

Housing Development Updates Exemption Orders For Stamp Duty Chee Hoe Associates

Stamp Duty Exemption No 7 Order 2018 P U A 378

Changes Proposed To Stamp Act In Malaysia Conventus Law

C2 Stamp Duty The Malaysian Institute Of Certified Public

C2 Stamp Duty Malaysian Institute Of Accountants

Gift Deed Conditions And Stamp Duty

Stamp Duty Malaysia 2019 New Updates Youtube

Exemption Of Stamp Duty And Capital Value Tax Cvt Through Finance Act 2020 Revenue Estate Department Stamp Duty Finance Tax

Sy Lee Co Newsletter 31 2019 Stamp Duty Exemption Facebook

Stamp Duty Exemptions Malaysia Asean Business News

Stamp Duty For Transfer Or Assignment Of Intellectual Property Koo Chin Nam Co

Most Important Stamp Duty Exemptions For Holding And Subsidiary Companies

Stamp Duty And Contracts Yee Partners